Commercial Appraisal Services in Massachusetts: Trusted Experts in

Accurate Property Valuations

Comprehensive valuations for multifamily buildings, office spaces, retail centers, and more.

At Boston Appraisal Services, we specialize in commercial appraisals, delivering accurate and comprehensive valuations across various property types. Whether you need a commercial property valuation for multifamily units, office spaces, or industrial warehouses, our expert team provides reliable assessments based on market trends, income potential, and property specifics.

Why Choose Boston Appraisal Services?

Why Choose Boston Appraisal Services?

Expertise Across All Commercial Property Types: Multifamily, office, retail, industrial, and more.

In-Depth Market Analysis: Data-driven real estate valuation tailored to your needs.

Trusted Professionals: FHA-certified, HUD-approved appraisers with over a decade of experience.

Fast Turnaround Times: Get your report when you need it most.

Comprehensive Commercial Appraisal Services

Comprehensive Commercial Appraisal Services

Comprehensive Commercial Appraisal Services

Multifamily/Apartment Buildings (5+ Units) Appraisals. Multifamily appraisals focus on income potential, analyzing rental income, vacancy rates, operating expenses, and market trends.

Office Building Appraisals

Office appraisals evaluate factors such as location, design, tenant improvements, and rental income potential. These appraisals enable property owners and investors to make informed decisions about leasing, selling, or refinancing office spaces.

Retail Property Appraisals

Appraising retail properties involves analyzing income potential, local market data, and property condition. Our retail appraisals help owners and managers understand their properties’ performance compared to the local retail market.

New Construction/ Development Appraisals

Appraisals for new construction projects assess development plans, construction quality, and market demand. These are vital for developers to secure financing or evaluate project viability.

Subdivision Appraisals

Subdivision appraisals determine the value of land divided into lots for residential development. They consider zoning regulations, market demand, and infrastructure to provide an accurate property valuation.

Industrial/Warehouse/ Light Manufacturing Property Appraisals

These appraisals focus on properties used for production, storage, or distribution. They are essential for investors and businesses to understand the value and ROI of specialized industrial properties.

Special Uses/ Churches/ School Building Appraisals

Unique properties like churches and schools require specialized appraisals. We assess replacement costs, adaptability, and market data to deliver accurate valuations.

What Our Clients Say

What Our Clients Say

“As a Senior Housing Specialist with HUD, I review appraisals for compliance. I could not let this day go by without letting you know that the appraisal I just reviewed by BAS was the best. I was able to locate every detail of information without a problem. The appraiser’s comments were outstanding. The appraisal was prepared in such an easy to read format, and so detailed that anyone would understand the appraisal process. Thank you very much for such a well-prepared appraisal.”

U.S. Department of Housing and Urban Development, Quality Assurance Division

“BAS’s knowledge of the market and expertise have been of great service to me over the years. They consistently deliver comprehensive and timely appraisals and are among the most dependable companies I work with. The court accepts their reports. I can confidently recommend BAS and I know they will prove to be an asset to you. They are professional and provide exceptional service whenever required.”

Schrier & Associates, P.C.

"Boston Appraisal is our go-to company! Not only can we depend on them for accurate and realistic appraisal values but also for stellar customer service and response time!"

Harper Financial

“They always go the extra mile when we have any questions and never fail to provide us with accurate valuations.”

CrossCountry Mortgage, Inc.

“There are often new appraisers trying to solicit my business and none have matched their superior service.”

“I have been working with Boston Appraisal Services for years and they have always exceeded my expectations with their reports and their research. I would recommend their services to everyone!”

RCM Tax Services

“We have been working with BAS for years and it has always been an excellent experience. They combine punctual, dependable service with impressive speed and incredible customer support. They have been an advantage in our work with estates and tax cases. The provide expert valuations for a range of different properties, delivering exemplary appraisal reports that cater to our specific needs. We routinely use their reports to settle family differences in estate matters.”

Law Office of Walter J. Kelly

Why Clients Trust Boston Appraisal Services for Commercial Appraisals?

Why Clients Trust Boston Appraisal Services for Commercial Appraisals?

Licensed and Certified Appraisers

Accurate, Timely Reports Recognized by Courts and Attorneys

Serving Massachusetts and New England for Over a Decade

Extensive Knowledge of the Massachusetts Property Market

Real Estate Appraisal Services Coverage in Boston and New England

Real Estate Appraisal Services Coverage in Boston and New England

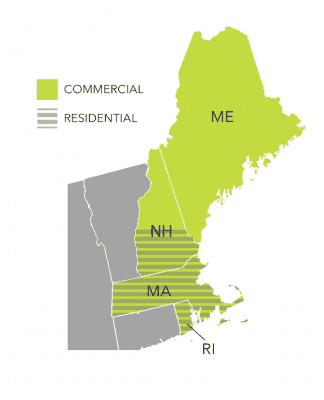

Boston Appraisal Services provides comprehensive real estate appraisals throughout Massachusetts, covering Suffolk, Middlesex, Norfolk, Essex, Plymouth, Bristol, and Worcester counties for residential appraisals, and all counties for commercial appraisals. In RI, we cover Providence, Bristol, Newport, and Kent counties for both residential and commercial needs. In NH, we offer residential and commercial appraisals in Hillsborough, Merrimack, Rockingham, and Strafford counties. Additionally, we provide commercial appraisal services in York and Cumberland counties in ME.

Featured Blogs

Frequently Asked Question On Commercial Appraisals Services

Frequently Asked Question On Commercial Appraisals Services

What types of commercial properties do you appraise?

We provide appraisals for a wide range of commercial properties, including multifamily apartment buildings, office spaces, retail centers, industrial facilities, new developments, and special-use properties like schools and churches.

Why is a commercial appraisal essential for my property?

A commercial appraisal delivers an accurate, professional valuation, helping property owners, investors, and lenders make informed decisions regarding financing, selling, purchasing, or leasing. It ensures transparency and avoids financial risks associated with over- or under-valuation.

What factors are considered in a commercial property appraisal?

We evaluate multiple factors, including the property’s location, income potential, market trends, physical condition, and comparable sales data. For income-producing properties, rental income, vacancy rates, and operating expenses are also analyzed.

How long does it take to complete a commercial appraisal?

The timeline depends on the complexity of the property, but most commercial appraisals are completed within 10-15 business days. For urgent cases, we offer expedited services to meet your needs.