Accurate Commercial Appraisal Services in Massachusetts

Comprehensive valuations for multifamily buildings, office spaces, retail centers, and more.

At Boston Appraisal Services, we specialize in commercial appraisals, delivering accurate and comprehensive valuations across various property types. Whether you need a commercial property valuation for multifamily units, office spaces, or industrial warehouses, our expert team provides reliable assessments based on market trends, income potential, and property specifics.

Why Choose Boston Appraisal Services?

Expertise Across All Commercial Property Types: Multifamily, office, retail, industrial, and more.

In-Depth Market Analysis: Data-driven real estate valuation tailored to your needs.

Trusted Professionals: FHA-certified, HUD-approved appraisers with over a decade of experience.

Fast Turnaround Times: Get your report when you need it most.

Comprehensive Commercial Appraisal Services

Comprehensive Commercial Appraisal Services

Multifamily/Apartment Buildings (5+ Units) Appraisals. Multifamily appraisals focus on income potential, analyzing rental income, vacancy rates, operating expenses, and market trends.

Office Building Appraisals

Office appraisals evaluate factors such as location, design, tenant improvements, and rental income potential. These appraisals enable property owners and investors to make informed decisions about leasing, selling, or refinancing office spaces.

Retail Property Appraisals

Appraising retail properties involves analyzing income potential, local market data, and property condition. Our retail appraisals help owners and managers understand their properties’ performance compared to the local retail market.

New Construction/Development Appraisals

Appraisals for new construction projects assess development plans, construction quality, and market demand. These are vital for developers to secure financing or evaluate project viability.

Subdivision Appraisals

Subdivision appraisals determine the value of land divided into lots for residential development. They consider zoning regulations, market demand, and infrastructure to provide an accurate property valuation.

Industrial/Warehouse/Light Manufacturing Property Appraisals

These appraisals focus on properties used for production, storage, or distribution. They are essential for investors and businesses to understand the value and ROI of specialized industrial properties.

Special Uses/Churches/School Building Appraisals

Unique properties like churches and schools require specialized appraisals. We assess replacement costs, adaptability, and market data to deliver accurate valuations.

What Our Clients Say

“As a Senior Housing Specialist with HUD, I review appraisals for compliance. I could not let this day go by without letting you know that the appraisal I just reviewed by BAS was the best. I was able to locate every detail of information without a problem. The appraiser’s comments were outstanding. The appraisal was prepared in such an easy to read format, and so detailed that anyone would understand the appraisal process. Thank you very much for such a well-prepared appraisal.”

U.S. Department of Housing and Urban Development, Quality Assurance Division

“BAS’s knowledge of the market and expertise have been of great service to me over the years. They consistently deliver comprehensive and timely appraisals and are among the most dependable companies I work with. The court accepts their reports. I can confidently recommend BAS and I know they will prove to be an asset to you. They are professional and provide exceptional service whenever required.”

Schrier & Associates, P.C.

"Boston Appraisal is our go-to company! Not only can we depend on them for accurate and realistic appraisal values but also for stellar customer service and response time!"

Harper Financial

“They always go the extra mile when we have any questions and never fail to provide us with accurate valuations.”

CrossCountry Mortgage, Inc.

“There are often new appraisers trying to solicit my business and none have matched their superior service.”

“I have been working with Boston Appraisal Services for years and they have always exceeded my expectations with their reports and their research. I would recommend their services to everyone!”

RCM Tax Services

“We have been working with BAS for years and it has always been an excellent experience. They combine punctual, dependable service with impressive speed and incredible customer support. They have been an advantage in our work with estates and tax cases. The provide expert valuations for a range of different properties, delivering exemplary appraisal reports that cater to our specific needs. We routinely use their reports to settle family differences in estate matters.”

Law Office of Walter J. Kelly

Why Clients Trust Boston Appraisal Services for Commercial Appraisals

Licensed and Certified Appraisers

Accurate, Timely Reports Recognized by Courts and Attorneys

Serving Massachusetts and New England for Over a Decade

Extensive Knowledge of the Massachusetts Property Market

Real Estate Appraisal Services Coverage in Boston and New England

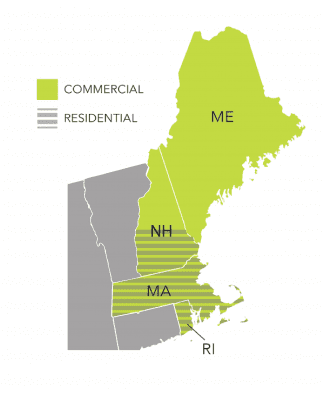

Boston Appraisal Services provides comprehensive real estate appraisals throughout Massachusetts, covering Suffolk, Middlesex, Norfolk, Essex, Plymouth, Bristol, and Worcester counties for residential appraisals, and all counties for commercial appraisals. In RI, we cover Providence, Bristol, Newport, and Kent counties for both residential and commercial needs. In NH, we offer residential and commercial appraisals in Hillsborough, Merrimack, Rockingham, and Strafford counties. Additionally, we provide commercial appraisal services in York and Cumberland counties in ME.

Request Your Commercial Appraisal Quote

Frequently Asked Question On Commercial Appraisals Services

What types of commercial properties do you appraise?

We provide appraisals for a wide range of commercial properties, including multifamily apartment buildings, office spaces, retail centers, industrial facilities, new developments, and special-use properties like schools and churches.

Why is a commercial appraisal essential for my property?

A commercial appraisal delivers an accurate, professional valuation, helping property owners, investors, and lenders make informed decisions regarding financing, selling, purchasing, or leasing. It ensures transparency and avoids financial risks associated with over- or under-valuation.

What factors are considered in a commercial property appraisal?

We evaluate multiple factors, including the property’s location, income potential, market trends, physical condition, and comparable sales data. For income-producing properties, rental income, vacancy rates, and operating expenses are also analyzed.

How long does it take to complete a commercial appraisal?

The timeline depends on the complexity of the property, but most commercial appraisals are completed within 10-15 business days. For urgent cases, we offer expedited services to meet your needs.

The COVID-19 pandemic has dramatically reshaped the real estate market. From record-low mortgage rates to shifts in buyer behavior, these trends signal a new era for the industry.

Welcome to 2020—a year defined by COVID-19, social distancing, self-imposed lockdowns, and a surge in Zoom meetings. Amid riots and protests, America has adapted remarkably to lifestyle and workplace changes. However, as life begins its journey toward a new normal, it’s crucial to examine the real estate market, assess the pandemic’s impact, and anticipate how these changes will shape the industry’s future.

COVID-19 Impact on the Mortgage Market

One of the positive results of this global pandemic is the affect it has had on the U.S. mortgage market. On March 15, the Federal Reserve lowered the prime rate to zero in response to the corona virus outbreak. This dropped 30-year mortgage rates to the floor – and we are happy to say that it stayed there. As of June 18, 2020, Freddie Mac reported in their Primary Mortgage Market Survey that 30-year fixed rate mortgages are averaging 3.13%. There are some lenders quoting rates as low as 2.75% for top-tier borrowers. This is the lowest rate in 30 years.

These low rates combined with easing of lockdown restrictions are going to drive a dramatic increase in purchase demand. In fact, activity is up over 20% from a year ago. “I think rate levels will be directly tied to the ability of the economy to recover. If it goes better than expected, rates would rise, and vice versa if things remain sluggish. Either way, the Fed is committed to keeping shorter-term rates lower for longer, and that will help to anchor longer-term rates like mortgages to some extent,” said Matthew Graham, chief operating officer at Mortgage News Daily.

What does this mean for borrowers?

Anyone who is in the position to purchase real estate should act now before the next corona virus wave hits. While mortgage rates may inch down a bit more, it will not be a significant shift, so there is no need to wait for rates to drop. On the other hand, if the economy recovers quicker than expected, we could see Feds bring the rates up a bit to slow demand.

COVID-19 Impact on Buyers and Sellers

These low loan rates are pushing buyers to risk virus exposure in search of better housing. This is good news for sellers who have suffered from a stagnate market during the first quarter of 2020. Compared with May of 2019, existing home sales were down 26.6%. This was the lowest level since July, 2010 and is part of a three-month decline in sales. Much of this drop can be attributed to peaks in the pandemic during March and April. The chief economist for the National Association of Realtors (NAR), Lawrence Yun, predicts that “Home sales will surely rise in the upcoming months with the economy reopening, and could even surpass one-year-ago figures in the second half of the year.”

During the height of the pandemic, new home construction ground to a halt. It is hoped that this will start to soon ramp up again to meet the rising housing demand. Without additional new homes coming into the market, home prices will rise too fast and quickly exceed affordability for first-time home buyers – even with the record-low mortgage rates.

Interestingly, the first wave of the pandemic has not lasted long enough to drive down sales prices and create a buyer’s market. The spring is a relatively slow period during a standard annual real estate season. The NAR reports that median sales prices in May increased 2.3% over last year establishing a median price of $284,600.

What does this mean for buyers?

Low mortgage rates mean you can get significantly more home for a much smaller payment. Now may be a good time to go shopping for a new home – especially before the predicted fall/winter second COVID-19 wave begins.

What does this mean for sellers?

We are not expecting price reductions at this time and experts are predicting an above-active summer of activity. Listings that feature virtual tours will have greater appeal to buyers who are nervous about virus exposure. Due to the increasing demand to work from home, home offices will have increased appeal. Families will appreciate private backyards and play areas rather than close proximity to public parks.

COVID-19 Impact on Investors

There has been less of an impact on the commercial real estate sector due to COVID-19. Cushman and Wakefield summed it up well when they said that “it’s premature to draw strong inferences about the virus’s impact on property markets. The commercial real estate sector is not the stock market. It’s slower moving and the leasing fundamentals don’t swing wildly from day to day.” While we are not seeing an impact on prices, rental rates, or investor returns at this point, there are areas that an investor may want to keep on the lookout.

JLL Capital Markets has recently released their COVID-19 Global Real Estate Implications report. As can be imagined, they stated that there will continue to be a high demand for medical office space, regional manufacturing facilities and associated logistics, along with storage space for companies with lean supply chains and low inventory cover. Office space offering a more flexible layout or private offices will have increased demand. If more businesses endorse a more permanent work-at-house outsourcing solution, there could be a period of office downsizing.

In a recent addition to the Immigration Policy, the new order will restrict J-1 (short-term exchange visas), L1 and H1 Visas. A reduction in international students, the ban on skilled workers and issuance of green-cards will pose short-term risk to the demand of housing created by these people.

What does this mean for investors?

With depressingly low government bond yields, real estate continues to offer good risk-adjusted returns in spite of any COVID-19 risk. JLL advises that based on the low interest rate environment; there is a good case for additional portfolio diversification.

Medical experts are saying that COVID-19 is going to be around for longer than we would like. Dealing with it is going to create a new normal, but the real estate market will survive. In spite of the health ramifications, experts in the real estate industry predict a strong recovery and stable prices.

The COVID-19 pandemic has dramatically reshaped the real estate market. From record-low mortgage rates to shifts in buyer behavior, these trends signal a new era for the industry.

Welcome to 2020—a year defined by COVID-19, social distancing, self-imposed lockdowns, and a surge in Zoom meetings. Amid riots and protests, America has adapted remarkably to lifestyle and workplace changes. However, as life begins its journey toward a new normal, it’s crucial to examine the real estate market, assess the pandemic’s impact, and anticipate how these changes will shape the industry’s future.

COVID-19 Impact on the Mortgage Market

One of the positive results of this global pandemic is the affect it has had on the U.S. mortgage market. On March 15, the Federal Reserve lowered the prime rate to zero in response to the corona virus outbreak. This dropped 30-year mortgage rates to the floor – and we are happy to say that it stayed there. As of June 18, 2020, Freddie Mac reported in their Primary Mortgage Market Survey that 30-year fixed rate mortgages are averaging 3.13%. There are some lenders quoting rates as low as 2.75% for top-tier borrowers. This is the lowest rate in 30 years.

These low rates combined with easing of lockdown restrictions are going to drive a dramatic increase in purchase demand. In fact, activity is up over 20% from a year ago. “I think rate levels will be directly tied to the ability of the economy to recover. If it goes better than expected, rates would rise, and vice versa if things remain sluggish. Either way, the Fed is committed to keeping shorter-term rates lower for longer, and that will help to anchor longer-term rates like mortgages to some extent,” said Matthew Graham, chief operating officer at Mortgage News Daily.

What does this mean for borrowers?

Anyone who is in the position to purchase real estate should act now before the next corona virus wave hits. While mortgage rates may inch down a bit more, it will not be a significant shift, so there is no need to wait for rates to drop. On the other hand, if the economy recovers quicker than expected, we could see Feds bring the rates up a bit to slow demand.

COVID-19 Impact on Buyers and Sellers

These low loan rates are pushing buyers to risk virus exposure in search of better housing. This is good news for sellers who have suffered from a stagnate market during the first quarter of 2020. Compared with May of 2019, existing home sales were down 26.6%. This was the lowest level since July, 2010 and is part of a three-month decline in sales. Much of this drop can be attributed to peaks in the pandemic during March and April. The chief economist for the National Association of Realtors (NAR), Lawrence Yun, predicts that “Home sales will surely rise in the upcoming months with the economy reopening, and could even surpass one-year-ago figures in the second half of the year.”

During the height of the pandemic, new home construction ground to a halt. It is hoped that this will start to soon ramp up again to meet the rising housing demand. Without additional new homes coming into the market, home prices will rise too fast and quickly exceed affordability for first-time home buyers – even with the record-low mortgage rates.

Interestingly, the first wave of the pandemic has not lasted long enough to drive down sales prices and create a buyer’s market. The spring is a relatively slow period during a standard annual real estate season. The NAR reports that median sales prices in May increased 2.3% over last year establishing a median price of $284,600.

What does this mean for buyers?

Low mortgage rates mean you can get significantly more home for a much smaller payment. Now may be a good time to go shopping for a new home – especially before the predicted fall/winter second COVID-19 wave begins.

What does this mean for sellers?

We are not expecting price reductions at this time and experts are predicting an above-active summer of activity. Listings that feature virtual tours will have greater appeal to buyers who are nervous about virus exposure. Due to the increasing demand to work from home, home offices will have increased appeal. Families will appreciate private backyards and play areas rather than close proximity to public parks.

COVID-19 Impact on Investors

There has been less of an impact on the commercial real estate sector due to COVID-19. Cushman and Wakefield summed it up well when they said that “it’s premature to draw strong inferences about the virus’s impact on property markets. The commercial real estate sector is not the stock market. It’s slower moving and the leasing fundamentals don’t swing wildly from day to day.” While we are not seeing an impact on prices, rental rates, or investor returns at this point, there are areas that an investor may want to keep on the lookout.

JLL Capital Markets has recently released their COVID-19 Global Real Estate Implications report. As can be imagined, they stated that there will continue to be a high demand for medical office space, regional manufacturing facilities and associated logistics, along with storage space for companies with lean supply chains and low inventory cover. Office space offering a more flexible layout or private offices will have increased demand. If more businesses endorse a more permanent work-at-house outsourcing solution, there could be a period of office downsizing.

In a recent addition to the Immigration Policy, the new order will restrict J-1 (short-term exchange visas), L1 and H1 Visas. A reduction in international students, the ban on skilled workers and issuance of green-cards will pose short-term risk to the demand of housing created by these people.

What does this mean for investors?

With depressingly low government bond yields, real estate continues to offer good risk-adjusted returns in spite of any COVID-19 risk. JLL advises that based on the low interest rate environment; there is a good case for additional portfolio diversification.

Medical experts are saying that COVID-19 is going to be around for longer than we would like. Dealing with it is going to create a new normal, but the real estate market will survive. In spite of the health ramifications, experts in the real estate industry predict a strong recovery and stable prices.